Medicare Part D:

Drug Plan

Medicare Part D is the newest part of the Medicare program and provides coverage for prescription drugs. Individuals covered by Medicare have the option of enrolling in Part D plans, which are offered by private insurers. Note that these stand-alone plans are meant to be used with the original Medicare Parts A and B. Individuals who join a Medicare prescription drug plan typically pay a separate monthly premium in addition to the Part B premium. Because plans are designed and sold by private companies, the number and types of coverage choices, as well as prices, can vary considerably.

Individuals can sign up for a Medicare Part D prescription drug plan when they first become eligible for Medicare or during Medicare’s annual election period, which occurs between October 15 and December 7 of each year. During the annual election period (also known as the open enrollment period), they can also switch to a different Medicare drug plan if their plan coverage changes or their needs change. Type your paragraph here.

If a person decides not to join a Medicare drug plan when first eligible, he or she may do so at a later date but must pay a late-enrollment penalty. For each month that a person delays enrolling in a Part D plan, the premiums automatically increase by 1 percent. Thus, a client who puts off enrolling for one year will have a monthly premium that is 12 percent higher than another person who enrolled when first eligible. However, this penalty does not apply if clients have “creditable” drug coverage that is, coverage from another source such as a former employer’s health insurance plan.

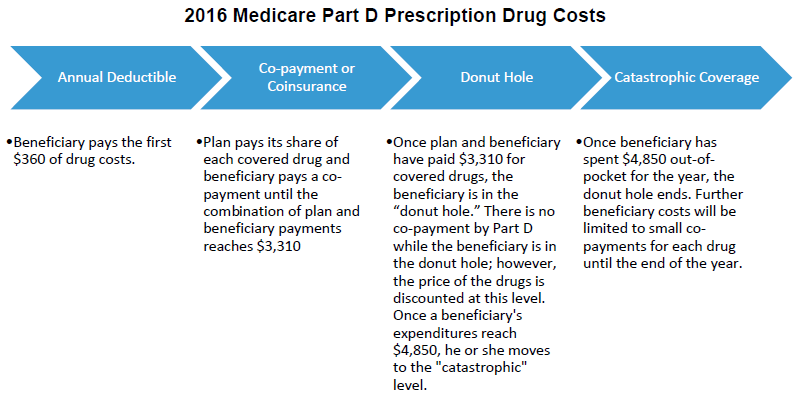

Once Part D’s annual deductible has been met ($360 in 2016), the plan covers 75 percent of prescription drug costs, but only up to a stated maximum ($3,310 in 2016). From this point on, Medicare benefits stop, and the insured must pay 100 percent of prescription drug costs until the total prescription drug costs reach another threshold level ($4,850 in 2016). This gap in coverage is known as the “donut-hole.” After reaching this threshold level, the insured is at the “catastrophic coverage” level: Medicare pays approximately 95 percent of prescription drug costs, and the insured will pay the greater of 5 percent coinsurance or a fixed co-payment for each prescription for the rest of the year. However, individuals with very low income and few assets pay no premiums or deductible for Part D coverage.

As part of the Patient Protection and Affordable Care Act, the donut-hole is scheduled to be eliminated gradually. In 2016, Part D enrollees who reach the donut-hole will receive a 50 percent discount on covered brand-name drugs, and the plan will pay another 5 percent, thereby giving enrollees a 55 percent discount on the cost of brand-name drugs (enrollees receive a 42 percent discount on generic drugs). However, the full retail price of the drugs (less the 5 percent paid by the plan) will apply to getting out of the donut-hole.

Over the next several years, the coverage gap will close. The enrollee’s share of the cost for both generics and brand-name prescription drugs will steadily decrease until 2020, when it reaches 25 percent—the same coinsurance percentage that applies to prescription drug costs below the initial coverage amount. At that point, the coverage gap will be eliminated.

For more information about Medicare, see http://www.medicare.gov.

For more information about Medicare, see http://www.medicare.gov.