Long Term Care Insurance

Policy Features and Options

|

Inflation Protection

Insureds may not need the benefits from their long-term care insurance policies for many years after the policies are purchased. Add to this the fact that the cost of long-term care increases year after year. Thus, the amount of protection a policy provides when it is purchased may not fully cover the cost of care when that care is needed. For example, suppose an individual purchased a policy today that provides a daily benefit amount of $200. That amount was selected because it represents the current daily cost of a private nursing home room in the insured’s community. |

But what if the insured didn’t need to enter a nursing home for another 18 years? Assuming a 5 percent annual increase, the daily cost of a private nursing home room at that point would be $481. A long-term care insurance policy with a $200 daily benefit would not cover even half the cost of the client’s nursing home care. And if the benefits were needed in 25 years, when the cost of a private room in a nursing home is projected to be $677, it would cover less than a third of the insured’s cost.

Inflation protection is an option that automatically increases a long-term care insurance policy’s benefit amount by a specified percentage or specified amount each year. This feature is so important that some states require inflation protection to be presented to an applicant for a long-term care insurance policy, and if it is rejected, the applicant must do so in writing.

Two types of inflation protection are available:

- Simple—A simple inflation protection feature adjusts the policy’s daily benefit amount each year by the same amount.

- Compound—A compound inflation protection feature adjusts the policy’s daily benefit by a rate that is compounded every year.

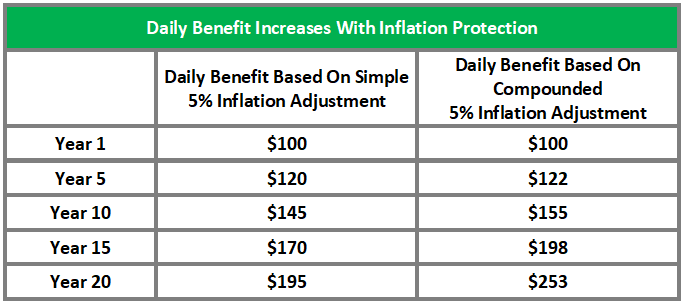

To illustrate, assume two individuals each purchase a long-term care policy that provides for a daily benefit amount of $100. The first insured elects to purchase a 5 percent simple inflation protection feature; the second chooses a 5 percent compound inflation protection feature. The daily benefit for Insured #1 will increase each year by $5; the daily benefit under Insured #2’s policy will increase each year at a 5 percent compounded rate. By year 20, Insured #1’s policy will provide a daily benefit of $195 and Insured #2’s policy will provide a daily benefit of $253.

A simple inflation adjustment may be appropriate for older buyers, but younger buyers should consider adjustments compounded annually, because a good amount of time is likely to pass before a claim would be made and benefits were to begin.