Establishing Your Plan

Defining a future need requires that certain assumptions be made. Projecting the dollar amount that will be necessary to fund a comfortable retirement is a function of four elements:

Each of these factors has significant impact on how much money will ultimately be needed. In turn, this amount determines how the money will be invested. Let’s briefly review each element.

- the accumulation period—the number of years to retirement

- the projected length of the retirement period—the individual’s life expectancy and that of his or her spouse

- the expected rate of inflation—the erosion of purchasing power

- the time value of money—the return on invested assets

Each of these factors has significant impact on how much money will ultimately be needed. In turn, this amount determines how the money will be invested. Let’s briefly review each element.

The Accumulation Period

The number of years that are available to accumulate retirement assets is important, because this time frame indicates to what extent time will be an ally or a foe. Obviously, the more time a person has to accumulate retirement assets, the better. The number of years available also indicates what kind of investment strategy a person can pursue. For example, longer periods allow for more aggressive investing; short periods may demand more conservative positions. Common retirement age assumptions are 60, 62, or 66. For some individuals, it may be earlier; for some, it may be later.

The number of years that are available to accumulate retirement assets is important, because this time frame indicates to what extent time will be an ally or a foe. Obviously, the more time a person has to accumulate retirement assets, the better. The number of years available also indicates what kind of investment strategy a person can pursue. For example, longer periods allow for more aggressive investing; short periods may demand more conservative positions. Common retirement age assumptions are 60, 62, or 66. For some individuals, it may be earlier; for some, it may be later.

Projected Length of Retirement Period (Life Expectancy)

A retirement plan must account for how long the retirement period is. At age 65, most individuals can expect to live another 20 years or so. Consider the following:

A retirement plan should assume a very conservative projection of 20, 25, or even 30 years as the duration of the retirement period.

A retirement plan must account for how long the retirement period is. At age 65, most individuals can expect to live another 20 years or so. Consider the following:

- A man’s life expectancy at birth is 76.4 years. At age 65, he can expect to live another 17.9 years, and at 75, he can look forward to another 11.1 years.

- A woman’s life expectancy at birth is now 81.2 years. At age 65, her remaining life expectancy is 20.4 years, and at age 75, it is another 12.9 years.

A retirement plan should assume a very conservative projection of 20, 25, or even 30 years as the duration of the retirement period.

Expected Rate of Inflation

Inflation is the general increase in prices and the decline in purchasing power. In other words, what $1 can purchase today will not be the same as what that $1 can purchase in the future. Inflation can seriously erode purchasing power over time, even when the rate is low.

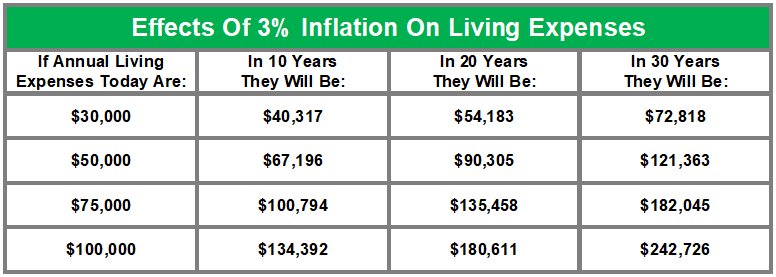

For example, an inflation rate of only 3 percent would have the following effects on living expenses:

Inflation is the general increase in prices and the decline in purchasing power. In other words, what $1 can purchase today will not be the same as what that $1 can purchase in the future. Inflation can seriously erode purchasing power over time, even when the rate is low.

For example, an inflation rate of only 3 percent would have the following effects on living expenses:

The significance of inflation on retirement is apparent, given the length of time one can expect retirement to extend. Retirement plans must account for inflation in two ways:

- the effect it has on income need projections—Retirement plans must address the ever-increasing income levels that will be necessary to preserve purchasing power over the period leading to retirement and during the retirement period itself. A retirement income need of $50,000 today will be $67,196 in ten years, $90,305 in 20 years, and $121,363—more than double—in 30 years, assuming a 3 percent annual rate of inflation.

- the effect it has on fixed income assets—Along these lines, a retirement plan must account for the effects that inflation will have on fixed income assets. For example, while some pension plans are indexed to provide cost-of-living benefit increases, most are not. Let’s say a retiree’s annual pension of $12,000 accounted for 18.5 percent of his or her $65,000 income need during the first year of retirement. If the pension is not indexed to inflation, and inflation were to run at an annual rate of 3 percent, then by year 10, the retiree’s income need has escalated to over $87,000. However, the pension benefit, still at $12,000, now covers only around 14 percent of that amount. To maintain a level standard of living, other assets must compensate for the amount of purchasing power lost from fixed income assets.

Sound retirement planning includes assumptions for inflation. It also requires a realization that when inflation rates are projected over long periods, the numbers are not likely to hold. This is one aspect of a retirement plan that must be continually monitored and adjusted over time.

Time Value of Money

Working in opposition to inflation is the time value of money, which is the growth of funds due to interest or growth earnings. For example, the value of $1 today will be worth more tomorrow when it is invested and earns a return. Retirement planning relies heavily on the time value of money to accumulate the funds needed for the future. In this respect, compound interest is a very powerful tool.

In fact, Albert Einstein considered compound interest the eighth wonder of the world. As the pundits have noted, people can save a given sum of money in one of two ways. One is to wait until the last minute and save it all at once; the second is to start early, put less aside, and let the power of compound interest complete the task. Over time, compound interest can make a sustaining and significant contribution to a client’s retirement plan.

Working in opposition to inflation is the time value of money, which is the growth of funds due to interest or growth earnings. For example, the value of $1 today will be worth more tomorrow when it is invested and earns a return. Retirement planning relies heavily on the time value of money to accumulate the funds needed for the future. In this respect, compound interest is a very powerful tool.

In fact, Albert Einstein considered compound interest the eighth wonder of the world. As the pundits have noted, people can save a given sum of money in one of two ways. One is to wait until the last minute and save it all at once; the second is to start early, put less aside, and let the power of compound interest complete the task. Over time, compound interest can make a sustaining and significant contribution to a client’s retirement plan.

The time value of money rewards those who start their retirement saving early. In fact, its power is self-sustaining. Consider the following scenario:

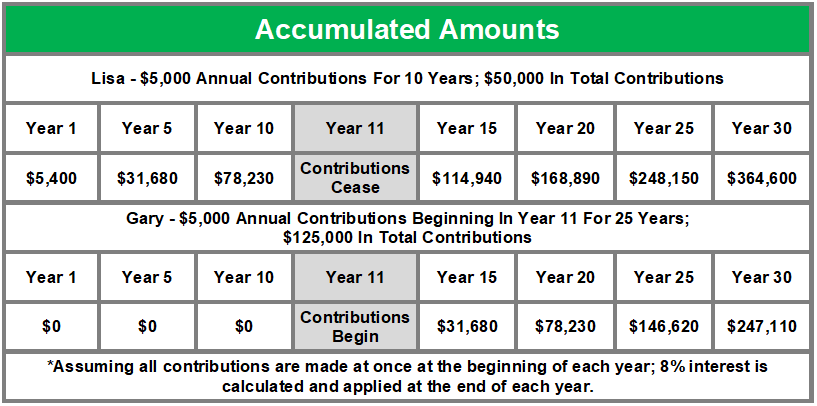

Lisa, age 30, decides to begin saving for retirement. She invests $5,000 a year and earns a constant 8 percent return. After ten years, she stops making contributions, but lets the money remain in the investment, earning 8 percent annually, for her retirement at age 65. Gary, also age 30, does not begin to save for his retirement until ten years later, when he is 40. From that point on, he makes an annual contribution of $5,000, and he too is able to earn a constant 8 percent return. Gary contributes $5,000 every year until he reaches age 65. By the time they’re both 65, who comes out ahead—Lisa, who invested a total of $50,000, or Gary, who invested a total of $125,000? The answer may surprise you: in 35 years, when they’re both 65, Lisa will have a total of almost $365,000; Gary will have accumulated $247,000.

The following table shows the accumulated amounts at the end of each five-year period.

Lisa, age 30, decides to begin saving for retirement. She invests $5,000 a year and earns a constant 8 percent return. After ten years, she stops making contributions, but lets the money remain in the investment, earning 8 percent annually, for her retirement at age 65. Gary, also age 30, does not begin to save for his retirement until ten years later, when he is 40. From that point on, he makes an annual contribution of $5,000, and he too is able to earn a constant 8 percent return. Gary contributes $5,000 every year until he reaches age 65. By the time they’re both 65, who comes out ahead—Lisa, who invested a total of $50,000, or Gary, who invested a total of $125,000? The answer may surprise you: in 35 years, when they’re both 65, Lisa will have a total of almost $365,000; Gary will have accumulated $247,000.

The following table shows the accumulated amounts at the end of each five-year period.

This example highlights two lessons. First, the earlier a person begins a plan of accumulation, the more power the compound interest will have. Second, waiting has a real cost. In the first ten years of her saving plan, Lisa had accumulated over $78,000 through contributions and earnings. Even without any more contributions, that $78,000 propelled her investment forward for the next 25 years to the point that she was able to achieve a total amount greater than seven times what she had deposited. By delaying his contributions for ten years, Gary—who actually contributed two and a half times as much to his savings than did Lisa—was able to accumulate less than twice his contributions.

As is the case with projecting inflation, estimating rates of return on investment assets over long periods is difficult. The rates will vary greatly given the economic environment and the types of financial instruments in which the retirement funds are invested. The general rule is to be conservative in estimates and projections and to revisit the plan and its assumptions regularly.

As is the case with projecting inflation, estimating rates of return on investment assets over long periods is difficult. The rates will vary greatly given the economic environment and the types of financial instruments in which the retirement funds are invested. The general rule is to be conservative in estimates and projections and to revisit the plan and its assumptions regularly.

Tax Deferral

A significant adjunct to compounding is tax deferral. Interest earnings on invested assets are normally taxed at current rates: 10, 15, 25, 28, 33, 35, or 39.6 percent, depending on one’s level of income. This effectively reduces the earnings one gains on invested assets. For instance, an 8 percent investment return for someone in the 28 percent tax bracket would be reduced to 5.76 percent (8 percent less 28 percent).

Conversely, tax-deferred investments accumulate interest unencumbered by taxes; they generate full interest on principal and full interest on interest. Interest earnings that otherwise would have been taxed remain intact to compound fully.

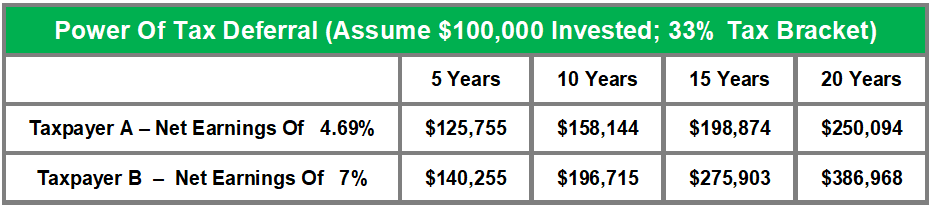

The power of tax deferral is significant. Consider two taxpayers, each of whom is in the 33 percent tax bracket. Taxpayer A invests $100,000 in a taxable investment that earns a constant 7 percent return. However, 33 percent of that return goes to taxes; his or her after-tax return is actually 4.69 percent. Taxpayer B invests $100,000 in a tax-deferred instrument that also earns a consistent 7 percent; no part of those earnings is taxed. The difference over 20 years is significant, as shown in the following:

A significant adjunct to compounding is tax deferral. Interest earnings on invested assets are normally taxed at current rates: 10, 15, 25, 28, 33, 35, or 39.6 percent, depending on one’s level of income. This effectively reduces the earnings one gains on invested assets. For instance, an 8 percent investment return for someone in the 28 percent tax bracket would be reduced to 5.76 percent (8 percent less 28 percent).

Conversely, tax-deferred investments accumulate interest unencumbered by taxes; they generate full interest on principal and full interest on interest. Interest earnings that otherwise would have been taxed remain intact to compound fully.

The power of tax deferral is significant. Consider two taxpayers, each of whom is in the 33 percent tax bracket. Taxpayer A invests $100,000 in a taxable investment that earns a constant 7 percent return. However, 33 percent of that return goes to taxes; his or her after-tax return is actually 4.69 percent. Taxpayer B invests $100,000 in a tax-deferred instrument that also earns a consistent 7 percent; no part of those earnings is taxed. The difference over 20 years is significant, as shown in the following:

As this table illustrates, the tax-deferred investment outperforms the taxable investment by $136,874. Even if the entire amount of the tax-deferred investment were withdrawn in a lump sum, at which point the $286,968 in earnings would be subject to tax, the taxes due (assuming the taxpayer is still in the 33 percent bracket) would be a little less than $95,000. The tax-deferred investment still comes out ahead.

Central to the accumulation of assets for retirement is using vehicles that provide for tax deferral. They include:

assumptions have been made with regard to life expectancy, inflation, and investment earnings, the next step is to estimate the amount of money that will be needed for retirement.

- qualified employer plans

- 401(k) and 403(b) plans

- traditional IRAs / Roth IRAs

- growth annuities

- life Insurance

- tax free municipal bonds

- long-term care insurance

assumptions have been made with regard to life expectancy, inflation, and investment earnings, the next step is to estimate the amount of money that will be needed for retirement.