Tax Deferral

Another advantage of using deferred annuities for accumulating funds for retirement is that all premiums deposited into the contract accumulate on a tax-deferred basis.

Earnings are taxed only when withdrawn, which enhances an annuity’s ability to generate growth over the long term. The power of tax deferral, which gives deferred annuities an important advantage over other products that are currently subject to income tax, is illustrated in the following example.

Earnings are taxed only when withdrawn, which enhances an annuity’s ability to generate growth over the long term. The power of tax deferral, which gives deferred annuities an important advantage over other products that are currently subject to income tax, is illustrated in the following example.

Example

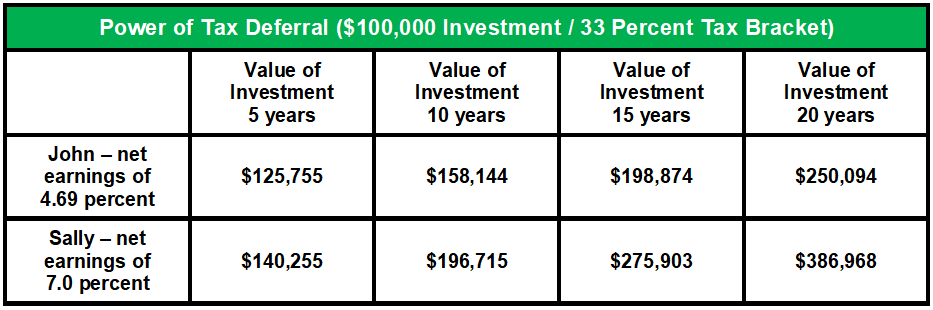

John and Sally are taxpayers who are both in the 33 percent tax bracket. John invests $100,000 in a mutual fund that earns a constant 7 percent return. However, 33 percent of that return must be paid in taxes, which means that his after-tax return is actually 4.69 percent. Sally, on the other hand, invests $100,000 in a fixed deferred annuity that also earns a consistent 7 percent return, but no part of those earnings is taxed. The difference in the growth of these investments over 20 years is significant, as shown in the following table.

John and Sally are taxpayers who are both in the 33 percent tax bracket. John invests $100,000 in a mutual fund that earns a constant 7 percent return. However, 33 percent of that return must be paid in taxes, which means that his after-tax return is actually 4.69 percent. Sally, on the other hand, invests $100,000 in a fixed deferred annuity that also earns a consistent 7 percent return, but no part of those earnings is taxed. The difference in the growth of these investments over 20 years is significant, as shown in the following table.

As the table shows, Sally’s tax-deferred annuity outperforms John’s taxable mutual fund by $136,874 over a 20-year period. Even if Sally withdrew the entire amount of her annuity in a lump sum (at which point the $286,968 in earnings would be subject to tax), the taxes due would be a little less than $95,000, so her tax-deferred annuity still comes out ahead.